How To Deduct Gst From Total In Excel

Just reread what I wrote you divide by 11 to get the ex-GST price. To calculate how much the price was before GST just divide by 11.

Best Excel Tutorial How To Calculate Gst

The following answer necessarily sets out general principles only.

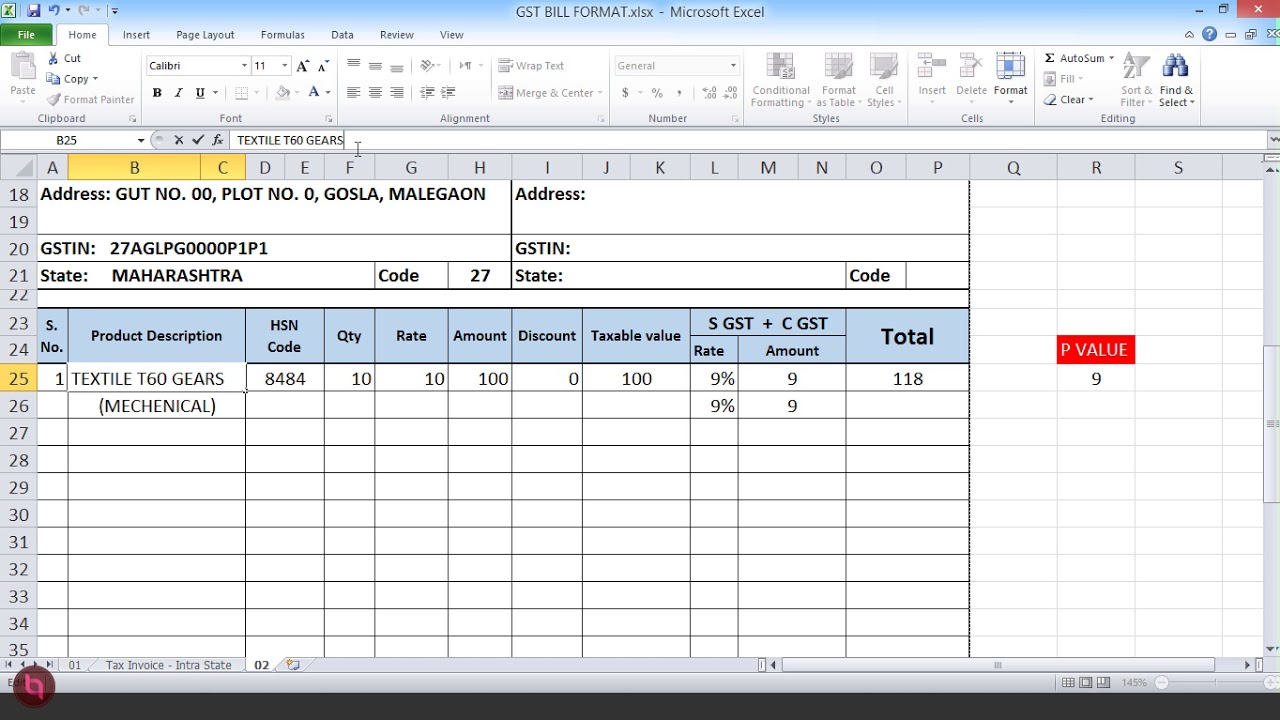

How to deduct gst from total in excel. The GST amount on the product is 909. Then click in the Excel function bar and input followed by the values you need to deduct. GST or Income tax formula in excel.

100 divided by 11 909. Thats a lot of manual work for small-business owners to do every time they want o calculate GSTuse our calculator instead. See the articleTax rate for all canadian remain the same as in 2017.

Select the range A1A6. For example input 25-5 in the function bar and press. The facts of particular cases always need to be considered carefully and it may be necessary to.

Lets say we have a product that is 100 GST inclusive. 909 multiplied by 10 GST rate of 10 9091. This is your bill without GST.

Divide the bill for the goods or services by one plus the GST. If youre not a formula hero use Paste Special to subtract in Excel without using formulas. Type a minus sign -.

To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The GST rate. The different slabs for GST are 5 12 18 and 28. I need a formula that calculates the -5 GST I can not just subtract Total - GST PRICE 1999 1999 1999 SUBTOTAL 5997 PST 8 480 GST 5 300 TOTAL 6777 TAKE OUT GST.

Click on the cell containing a minuend a number from which another number is to be subtracted. Example shown 300 is the GST amount. To calculate how much GST is included in a price just divide by 11.

Right click and then click Copy or press CTRL c. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. First select a cell to add the formula to.

In the example if your bill including GST was 229 then 229 divided by 105 equals 21810. Right click and then click Paste Special. So the end amount should be 6477.

For example if the tax rate is 6 divide the total amount of receipts by 106. GST calculation can be explained by simple illustration. And now write the percentage of tax in column B.

GST is levied on the final goods of the manufacturers. In the cell where you want to output the difference type the equals sign to begin your formula. Enter the Amount Excluding GST Total to enter as AO including GST amount This should equal the total value of the Tax Invoice Including GST 1.

If the products original price is. Total Amount of ReceiptRs 2714. Multiply by 23 divide by 3.

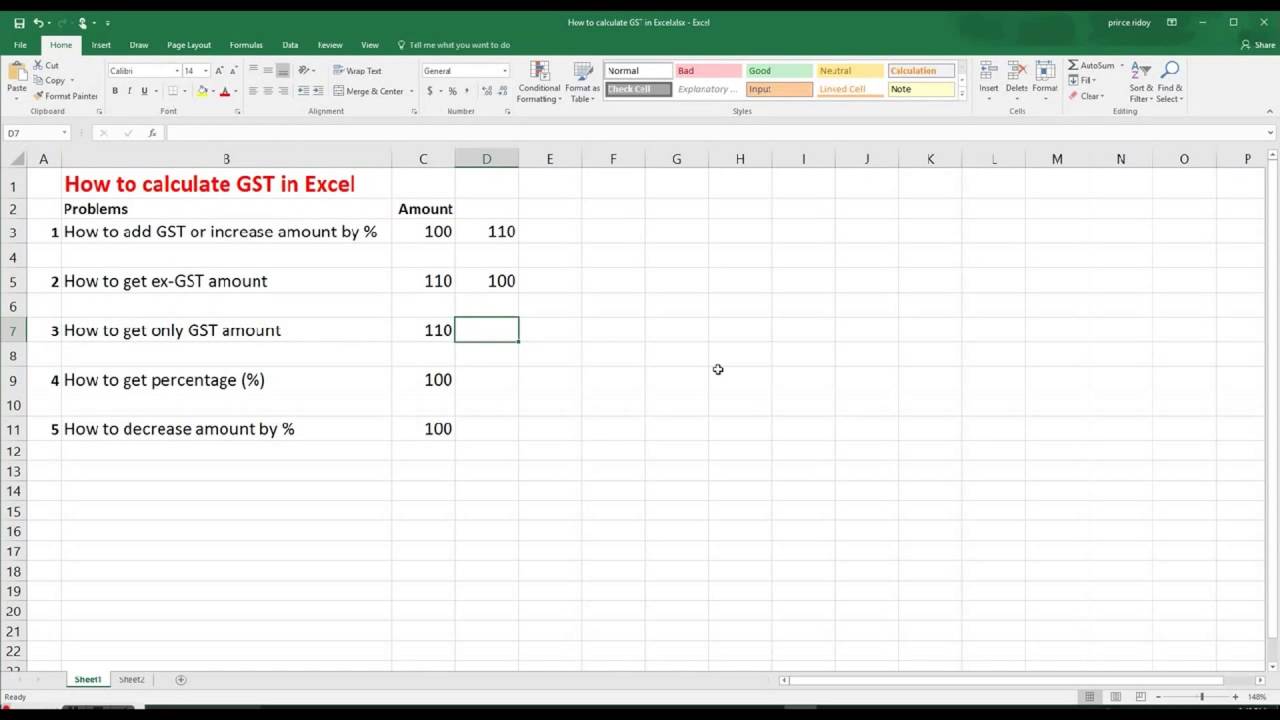

This Excel tutorial shows different techniques to calculate and find GST amounts. If the tax rate is 725 divide the total receipts by 10725. Lets see the calculation in practice.

Current HST GST and PST rates table of 2021. This can be explained with a simple mathematical formula mentioned below. To calculate the GST that is included in a companys receipts from items subject to tax divide the receipts by 1 the tax rate.

For example select cell C1. Now first of all write down the amount you want to calculate tax in column A. So the GST component TOTAL PRICE - TOTAL PRICE 11.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Subtract your bill without GST from Step 2 from the bill for the goods or. Multiply by 20 divide by 3.

This also helps you do some practice in Excel------Please watch. Its reference will be added to the formula automatically A2. 1000 and the GST rate applicable is 18 then the net price calculated will be 1000 1000X 18100 1000180 Rs.

If a goods or services is sold at Rs. Then apply the Tax Amount Calculator formula in column C as shown in the picture below.

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst Excel In Hindi Youtube

If The Total Amount Is Rs 2065 Including The Gst 18 Then What Is The Actual Price Quora

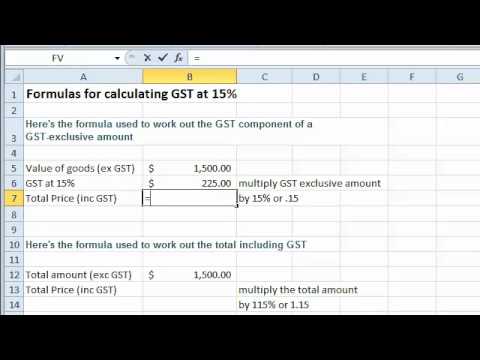

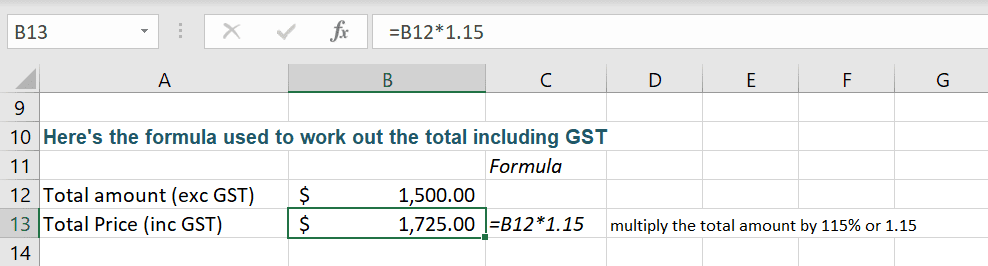

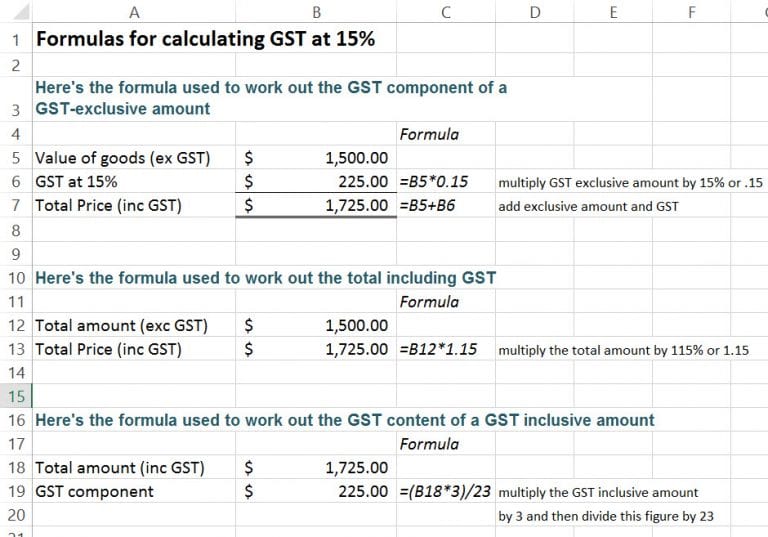

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

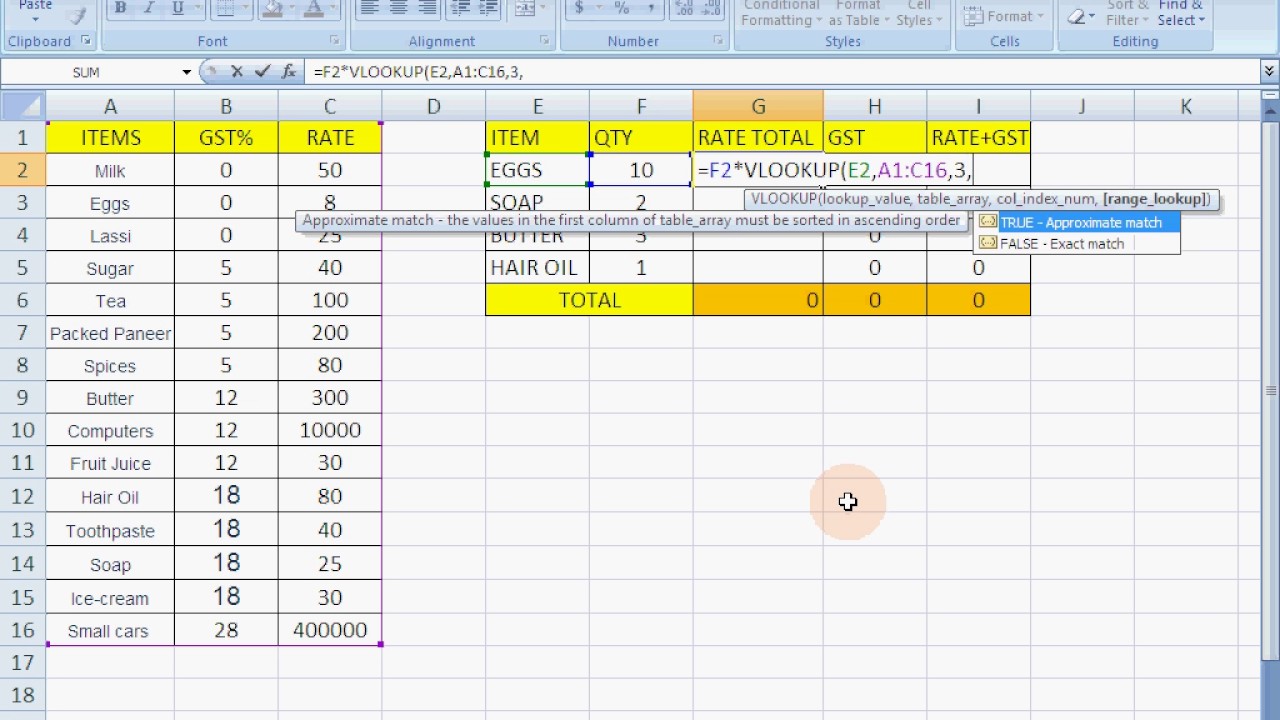

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

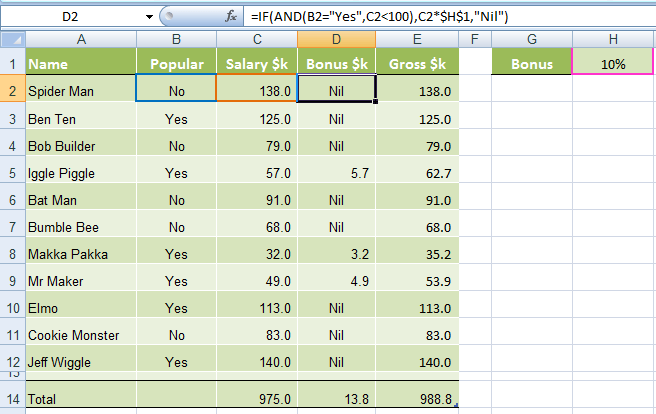

Excel If And Or Functions Explained My Online Training Hub

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

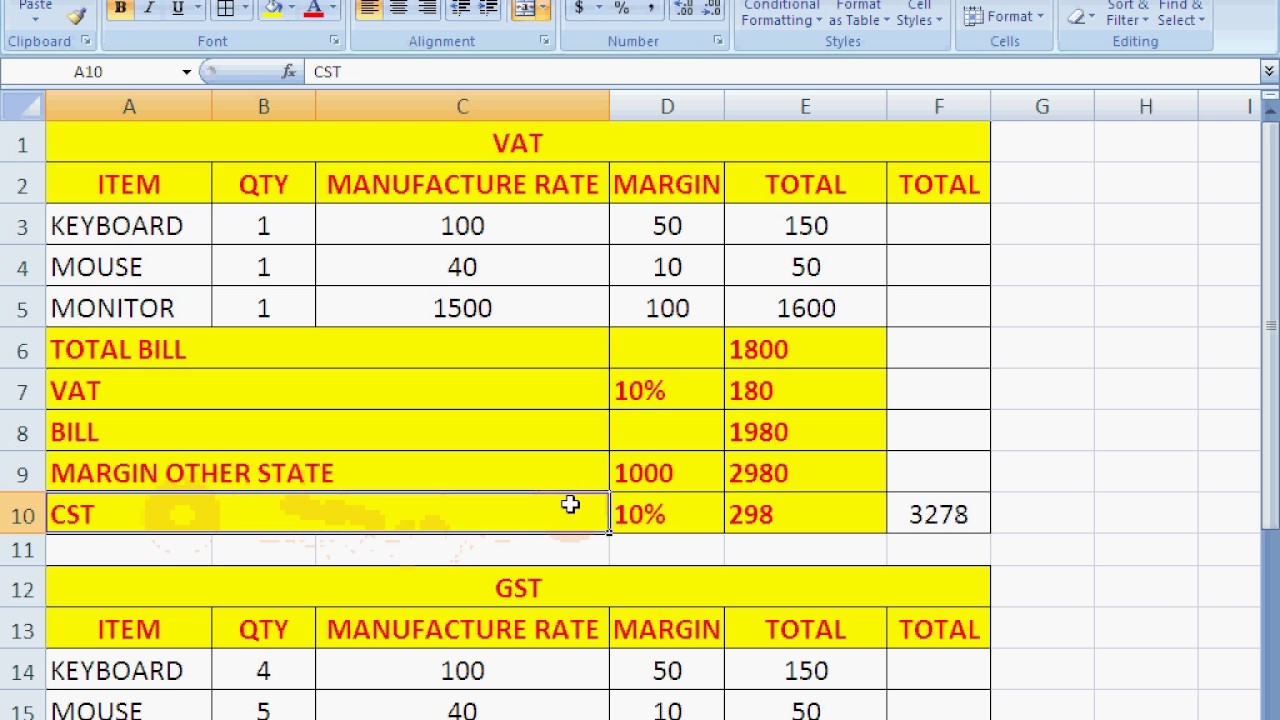

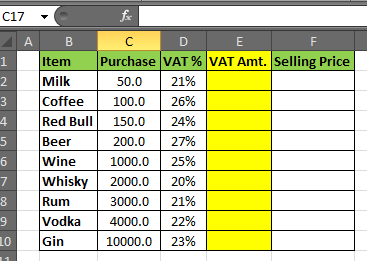

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Top 5 Ways To Use Percentages In Excel Trainers Direct Computer Courses Sydney Corporate Training

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst Or Income Tax In Excel

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

How To Calculate Gst Percentage In Excel How To Wiki 89

Gst Formula Excel In Hindi Youtube

How To Calculate Gst In Excel Wolasopa